There are two primary methods of satisfying your continuing education requirement: online text-based courses and webinar courses. Each has its own distinct advantages and at least one will fit your available time and learning approach to a tee.

What Is an Online Text-Based Course?

With an online text-based course, you’re presented course materials like a textbook, but much more interactive. The training is self-paced and delivered to your computer, tablet, and smartphone. You can select the courses you need, enroll and start courses at any time.

You’ll review the course materials and complete chapter quizzes along with a final exam for each course. During the course, you can return to the training whenever it is convenient for your schedule. The course progress bar tells you exactly where you left off.

The course quizzes and exams are scored instantly. Plus, you can take them as many times as necessary to pass. In many states, text-based courses require students to have a monitor (technically, called a “disinterested 3rd Party“) present when taking final exams. The monitor is required to attest that the student didn’t cheat on the exam.

Upon passing each class, a certificate is generated and available for printing or download. Credits earned are reported by BetterCE to the state department of insurance on the same day that each course is completed.

The main advantages of online text-based courses are:

- Enroll and start courses at any time.

- Available at any time — day or night.

- Complete at your own pace.

What Is a Webinar Course?

Webinar courses are like traditional classroom courses. They are instructor-led and delivered live in real-time using video conferencing.

You’ll need to be present on the webinar throughout the class to earn continuing education credits. Attendance is confirmed by requiring students to check in at random times throughout the webinar.

Students are not seen in video conferences, but they can interact and ask questions. Like online text-based courses, webinars are available to be taken on any computer, smartphone, or tablet with an Internet connection.

Certificates of course completion are generated shortly after course completion. Credits are reported to the department of insurance on the same day as completion.

Since webinars are live video conferences, they are offered at set times. They must be scheduled and attended on the dates and times offered.

The main advantages of insurance CE webinars are:

- No required reading materials.

- No quizzes or final exams.

- No final exam monitor requirements.

Benefits of Both Types of Continuing Education

While each type of course has its own distinct advantages, they both bring continuing education to you, wherever you are via the Internet. Both are state-approved for continuing education credits and reported the same day they are earned. Plus, they both offer the highest levels of licensing and compliance support available.

Note, too, that you have the option of blending your learning through a combination of webinar courses and online courses.

We offer online text-based courses in 28 states. We offer webinars in 18 states: Alabama, Arkansas, California, Florida, Georgia, Illinois, Indiana, Michigan, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Texas, Utah, and Wisconsin.

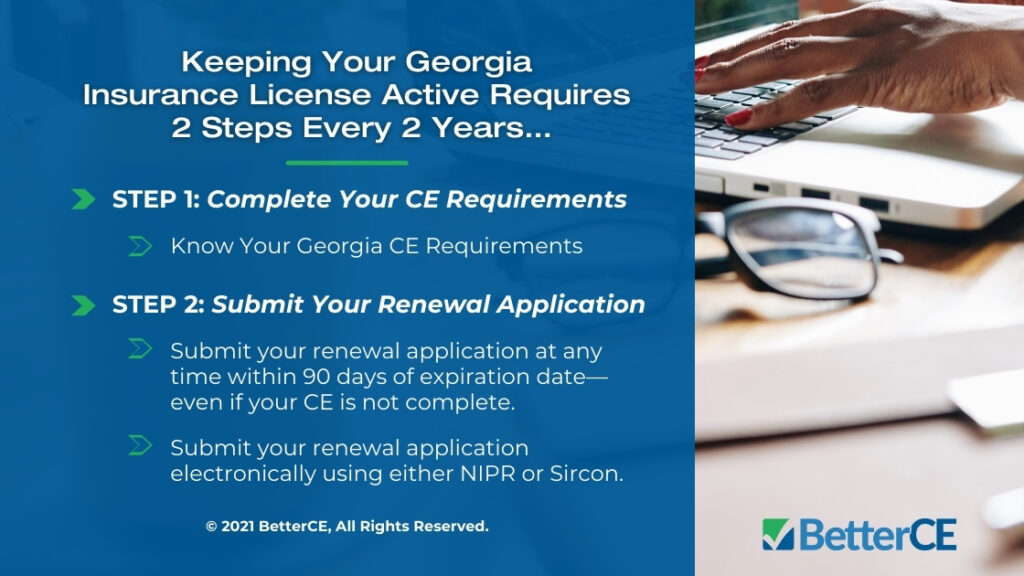

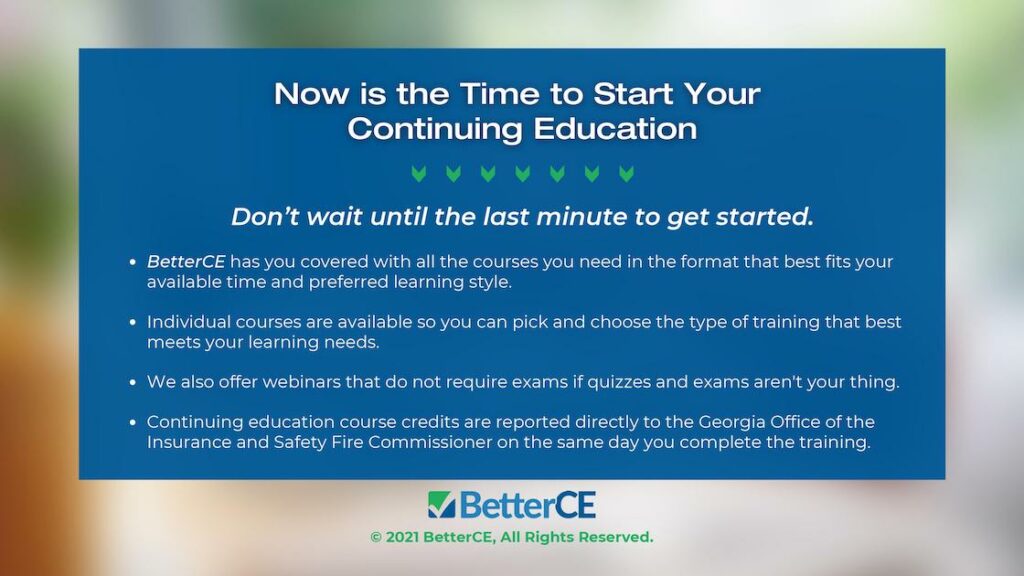

Now is the Time to Start Your Continuing Education

The good news is that we’ve got you covered with all the courses you need in the format that best fits your available time and your preferred learning style, whether that’s online text-based courses or webinars.

We offer complete compliance packages to make course selection super easy. We also offer individual courses so that you can pick and choose the type of training that best meets your learning needs.

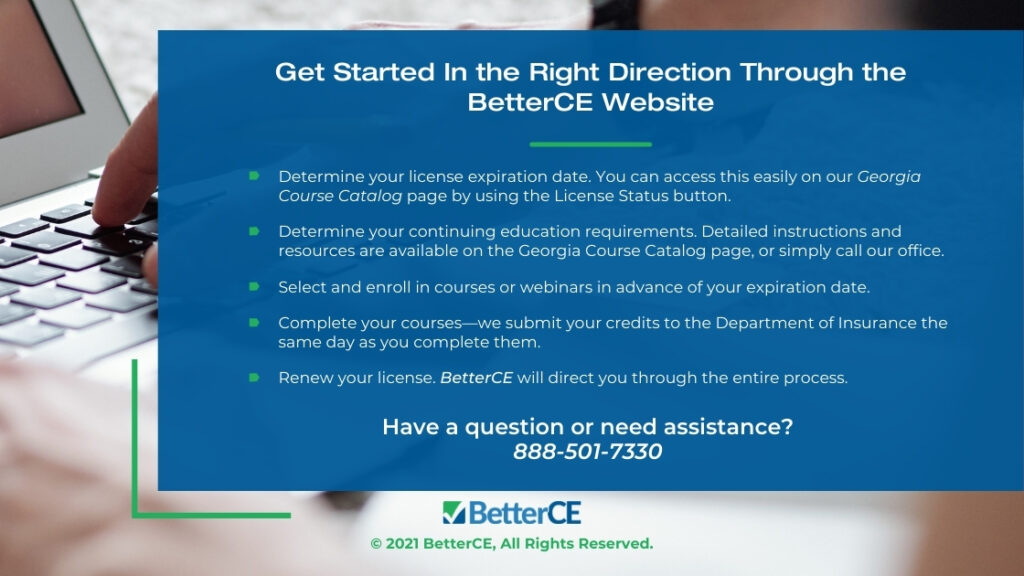

Start today with Better CE. Select all the courses you need with one click on our Course Catalog Page!

At BetterCE we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the insurance license renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to email as well as via our Contact Form. You can also sign up for convenient license renewal reminders on our contact page.