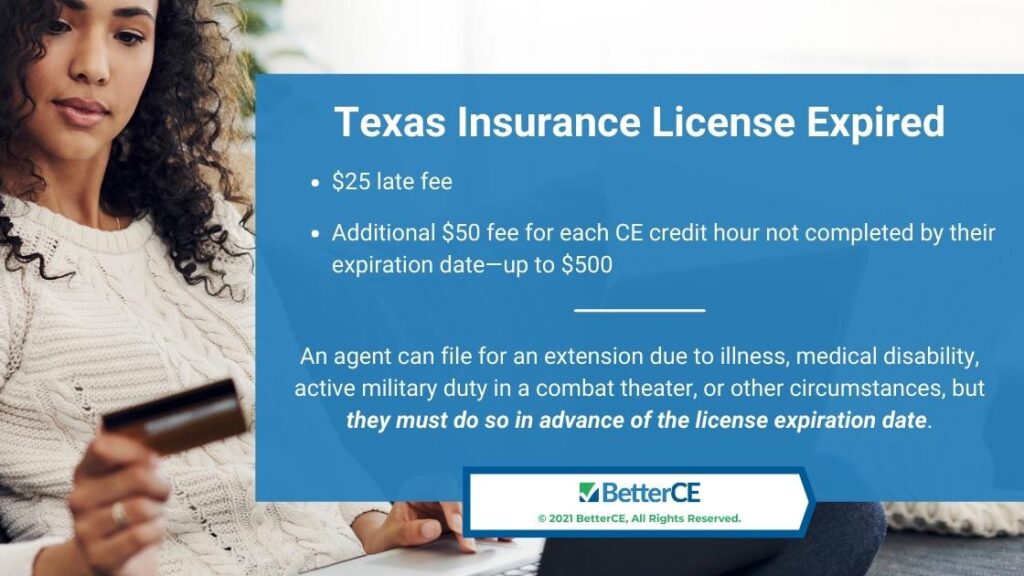

As you are aware, every two years you need to renew your insurance license in Texas. License expiration is the last day of your birth month. If you don’t complete your continuing education hours in time, there’s a $50 fine per hour up to a maximum $500 fine. Plus, you won’t be able to renew until all continuing education is completed. This article covers the steps required to renew your insurance license in Texas in detail.

As you can tell, keeping your license active and avoiding fines are good motivators to get things completed in time.

There are only two steps required for renewal:

- Complete the required continuing education.

- Submit the renewal application on time.

License renewal needs to happen within 60 days before license expiration. Check your license to determine the renewal date and year. If it’s coming up soon, sign up now for coursework to complete the continuing education requirements.

Step #1: Complete the Continuing Education Requirements

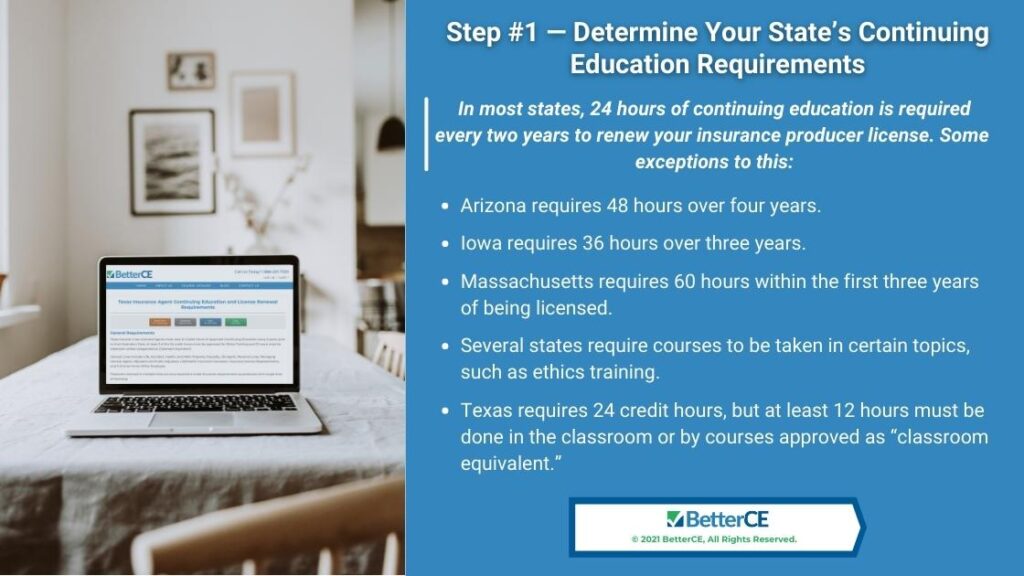

Texas General Lines Licensed Agents must take 24 credit hours of approved continuing education every two years. At least two of the 24 hours must be approved for ethics training. And 12 hours must be classroom or classroom equivalent training. Our webinars are approved as classroom equivalent training. There are no restrictions on the course subject matter, except for the two hours of ethics training.

Special Training Requirements

Agents who sell flood insurance need to complete a one-time three-hour continuing education course related to the National Flood Insurance Program. Long-term care partnership policy sales require an initial eight-hour training course followed by a four-hour long-term care course every two years. Those selling annuity products must complete an initial annuity best interest four-hour course followed by eight hours of continuing education each renewal period.

Exemptions/Extensions

Those who have been continuously licensed in the State of Texas for 20 years qualify for an exemption from continuing education.

An agent can also file for an extension of time to complete continuing education due to illness, medical disability, active military duty in a combat theater, or other circumstances.

You can find the application at Continuing Education Exemption or Extension.

Other Ways to Earn Texas CE Credit

Up to four hours of CE credit can be earned by an agent who is an active member of a state or national insurance association. That requires reviewing educational materials, attending educational presentations, and can include both state and national associations. Note that these credits only apply as self-study credits. See more at State and National Insurance Association Credit.

Step #2: Submit Your Renewal Application Prior to Expiration

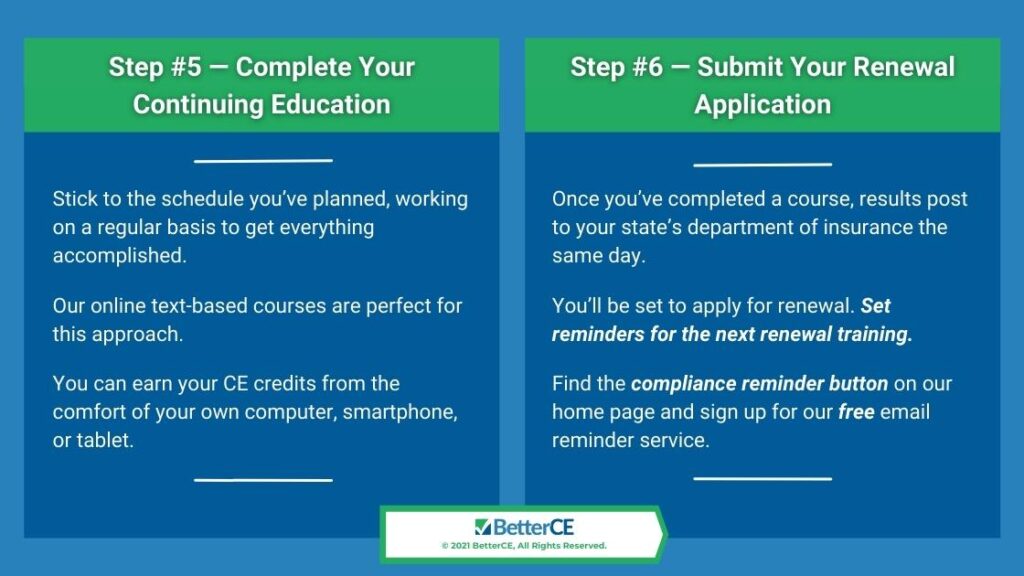

You can file your renewal application online at NIPR TX Agent Renewal or Sircon TX Agent Renewal. You’ll need to do this within the 60-day renewal window before the license expiration date.

Now is the Time to Start Your Continuing Education

Even with a full two years to accumulate your 24 hours of continuing education, there’s no reason to wait to get started. Wouldn’t it be nice to get it accomplished before the last minute?

We’ve got you covered with all the courses you need. You can find the full listing at Texas Insurance Continuing Education Course Catalog.

You’ll need to select at least 12 hours of training via webinars to satisfy the Texas requirement for courses taken in a classroom setting or classroom equivalent. Up to 12 hours can be obtained through online courses.

The online training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off.

Our webinar courses are instructor-led and delivered live using video conferencing. You’re required to be in attendance for the full class time, with check-ins at random times throughout the webinar to confirm your attendance. Students can interact and ask questions. Advantages to webinars include no required reading and no quizzes or final exams.

Completion Reported the Same Day

Note that your continuing education course credits will be reported directly to the Texas Department of Insurance on the same day you complete the training. So, if you’re in a rush to complete your continuing education, we’ve got you covered.

Summary of Steps to Renew Your Texas Insurance License

Even though we’ve mapped it out above, it’s still a great deal to digest. Here’s a quick summary to get you started on the path to renewal.

- Determine your license expiration date.

- Determine your continuing education requirements.

- Select and enroll in courses well in advance of your expiration date.

- Complete your courses – we submit your credits to the Texas Department of Insurance the same day you complete them.

- Renew your license.

We’re certain that everything you need to keep your license active is easily accessible through our website. If not, simply call our office and we’ll happily assist you.

If you’re near your renewal date, there’s no time to be lost. Sign up now for the most trusted and convenient solution for keeping your license active.

How to Reinstate Your Texas Insurance License

We’re Here to Help

At BetterCE we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the insurance license renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to email as well as via our Contact Form. On our contact page, you can also sign up for convenient license renewal reminders.