It’s critical to keep your California insurance license active. After all, you’ve spent a considerable amount of time and money to study for and pass the license exam. Even if you are not currently employed in the insurance industry, it’s best to preserve that investment and keep your ability to sell insurance active. Plus, it’s simple. This guide will walk you through everything you need to know for 2025.

As a leading provider of California insurance CE courses, BetterCE is here to guide agents through these 2025 updates to ensure compliance and success

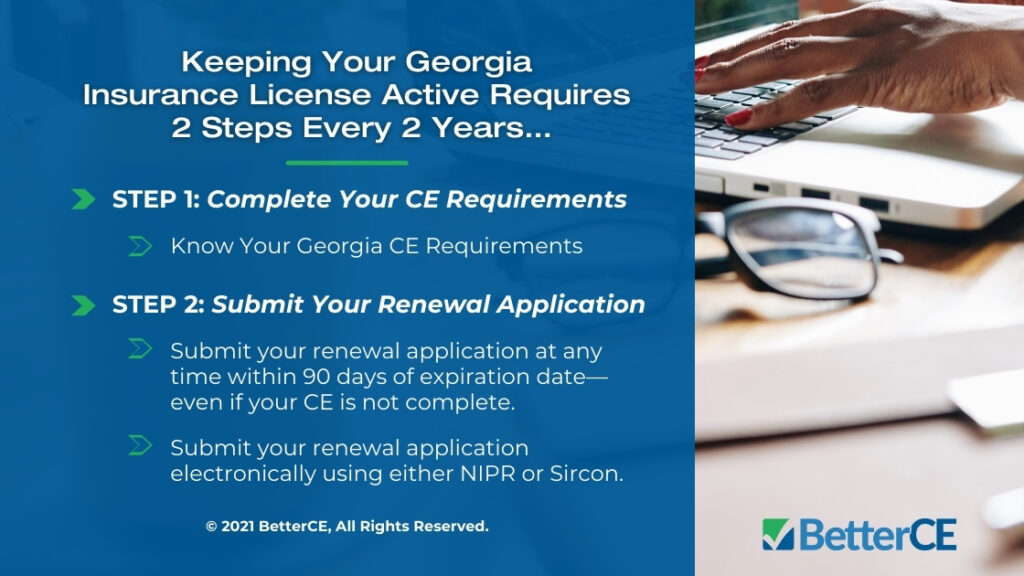

Keeping your California insurance license active requires only two steps every two years: completing the required continuing education and submitting the renewal application.

First Step: Complete Your Continuing Education Requirements

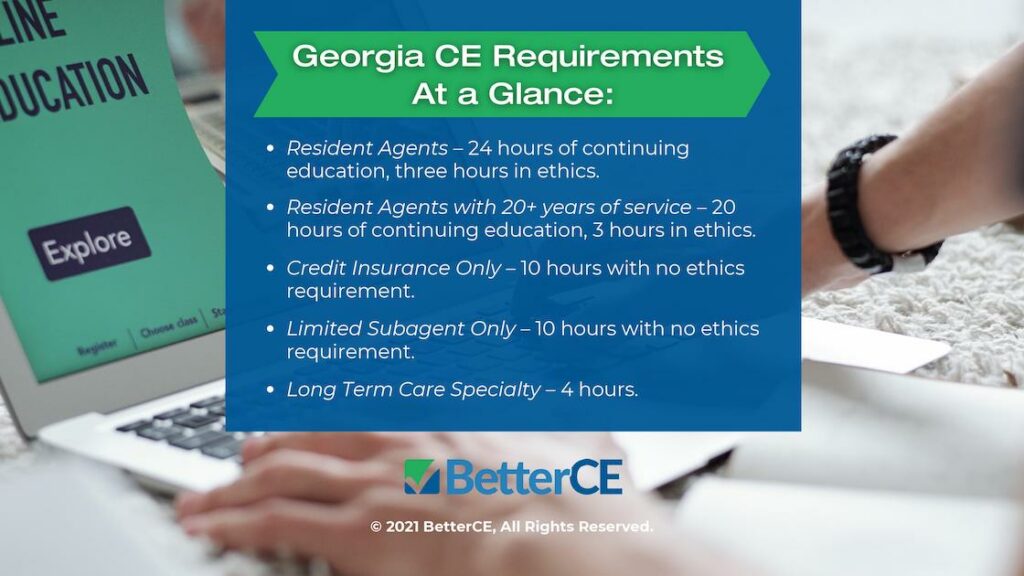

Your Continuing Education (CE) must be done every two years prior to your expiration date to be eligible to renew your California insurance license. This applies to all major lines licenses: life, property, casualty, accident and health, and personal lines. Of those 24 credits required, 21 must be done in topics approved for at least one of your license types. The 3 remaining credits must be approved for ethics training.

California CE requirements are “License Type-Specific”. CE must be completed in topics approved for your particular line of licensing. So, if you are licensed in life insurance, 21 of the credits you take need to be approved for the topic of life insurance. If you hold more than 1 line of licenses (life and property, for example) you only need to complete 24 credits total, but 21 credits of the courses you take must be approved for at least one of the lines of license you hold (the other 3 need to be in ethics).

What’s New in 2025? | California Insurance CE

Starting in 2025, there are significant new training requirements for California life insurance agents. You can read about these changes in our article Comprehensive Guide to California Life Insurance Agent Training Changes in 2025, but a summary is provided below.

These apply to both resident and non-resident agents who offer certain products in California.

- 4-Hour Life Insurance Training: This applies to agents who obtained their licenses after January 1, 2024, and are involved in selling non-term life insurance policies that include cash value. The training focuses on understanding product features, following compliance rules, and practicing ethical sales. Agents licensed before January 1, 2024, do not have to take this course unless they begin selling these products.

- 2-Hour Variable Life Insurance Training: Agents who sell variable life insurance products need to complete a 2-hour training course before every license renewal starting in 2025. This course covers the unique aspects of variable life products, including regulatory and investment-related topics.

- Updated Annuity Training: A revised 8-hour course introduces “Best Interest” standards, which require agents to prioritize the needs of their clients when making recommendations. Agents licensed before 2025 must complete this by July 1, 2025. Agents licensed after 2025 must complete it before selling annuities. Additionally, a 4-hour renewal course is required for annuity agents renewing their licenses after completing the updated 8-hour training.

Specialized Training CE Requirements for Certain Products in CA

There are special training requirements that need to be done if you sell certain products. Property and casualty agents who sell flood insurance need to complete a one-time, three-hour course on the National Flood Insurance Program. Agents who sell homeowners insurance must take a one-time homeowners insurance valuation course prior to estimating replacement value or explaining levels of coverage. Agents who sell long-term care products have a similar requirement: they must complete an initial eight-hour training course.

- Flood Insurance: A one-time, 3-hour course.

- Homeowners Insurance: A course on valuation is required before discussing coverage options.

- Long-Term Care Products: If you have been licensed for less than four years, you need 8 hours annually. If you have been licensed for four years or more, you need 8 hours every two years.

Exemptions — Experience and Age

If you’re age 70 or older and have been licensed for 30 consecutive years or more without any disciplinary action, you’re exempt from CE requirements The only caveat is that if you’re selling annuities or long-term care products, you still need to meet those training requirements.

Carry Over Credits

Finally, if you collect more CE credits than you need for your renewal, any excess credits can be carried over to the next renewal period. Any excess credits for ethics or special training courses will carry over as general credits only.

Second Step: Submit Your Renewal Application Prior to Expiration

All this needs to happen prior to your renewal date, which is the last day of the month of your original license date. Renewing your California insurance license is easy. The renewal application can be filed any time you are within 90 days of your license expiration date.

There are two online renewal options: the National Insurance Producer Registry (NIPR) or Sircon. You can also file a paper application through the California Department of Insurance.

The renewal fee is $188 per line of authority held. In addition, NIPR and SIRCON both charge a processing fee of $5.60.

You can start the renewal process up to 90 days before your expiration date. While it might be tempting to wait until the last minute to complete your CE, doing so is risky. Delays can lead to penalties, late fees, or even a lapse in your license.

Now is the Time to Start Your California Insurance Continuing Education

Since you have two years to accumulate your 24 hours of continuing education there’s no real reason to hurry. Right? Wrong!

Don’t wait until the last minute to get started and run the risk of penalties and late fees – or even worse – starting the licensing process from scratch.

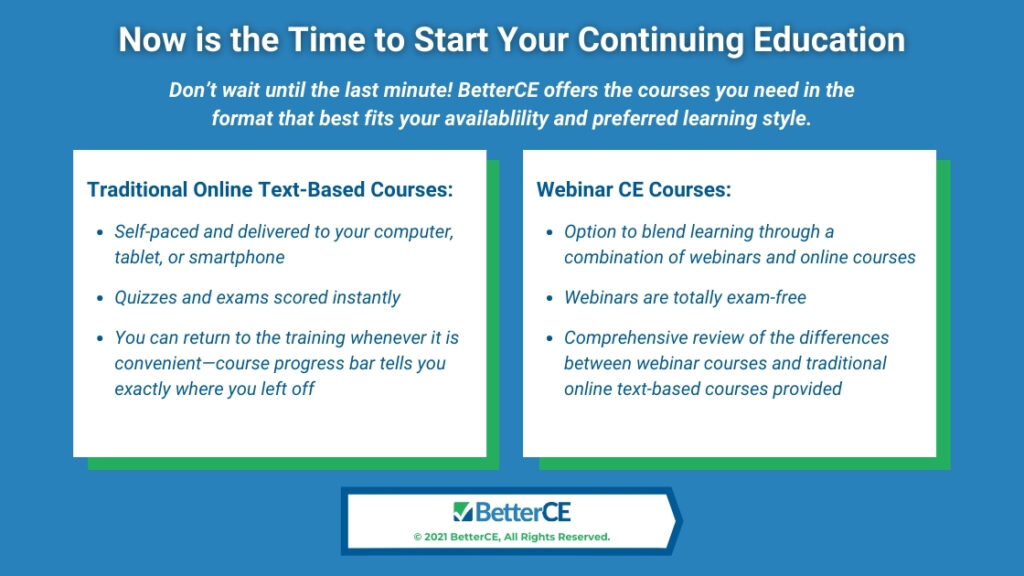

The good news is that we’ve got you covered with all the courses you need in the format that best fits your available time and your preferred learning style. You can find the full listing at California Insurance Continuing Education Course Catalog.

We offer complete compliance packages to make course selection super easy. You can select all the courses you need with one click. We also offer individual courses so that you can pick and choose the type of training that best meets your learning needs.

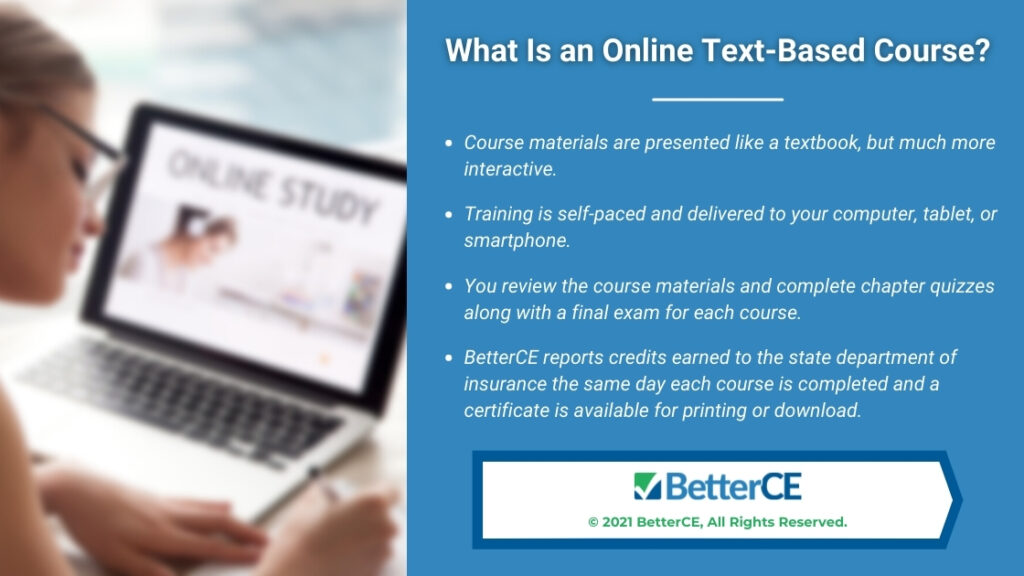

Traditional Online Text-Based Courses

The training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off.

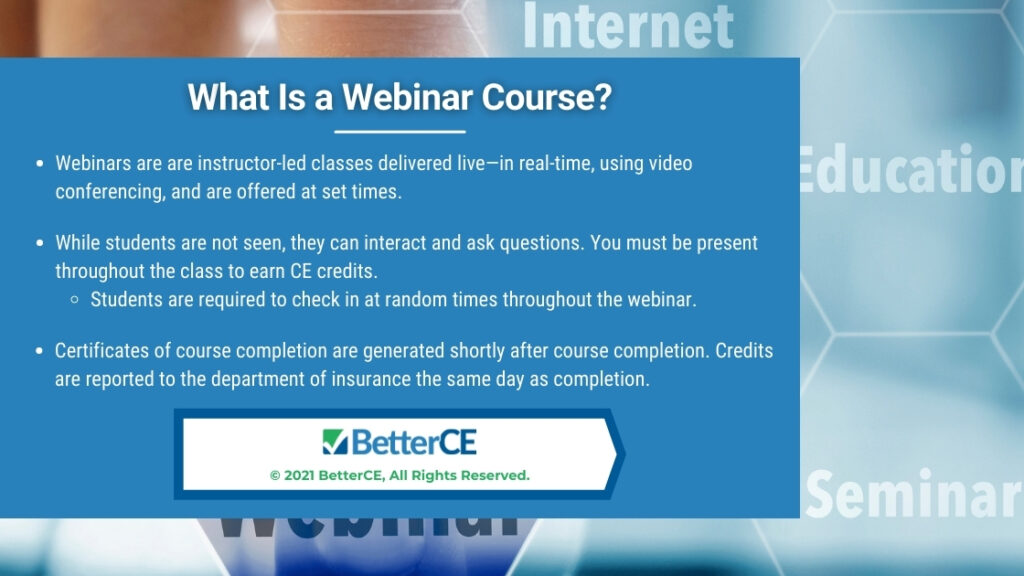

Webinar CE Courses

If exams aren’t your thing, we also offer webinars that are totally exam-free. You can find the current listing of approved webinars on our California Webinar Catalog.

Plus, you also have the option of blending your learning through a combination of webinars and online courses.

If you’re not sure which format fits, we’ve provided a comprehensive review of the differences between webinar courses and traditional online text-based courses.

Same Day Completion Reporting

Note that your continuing education course credits will be reported directly to the California Insurance Department on the same day you complete the training. So, if you’re in a rush to complete your continuing education, we’ve got you covered.

How to Keep Your California Insurance License Active Summary

That may seem like a lot to sift through, but we’re certain that everything you need to keep your license active is easily accessible through our website. If not, simply call our office and we’ll happily assist you. Here’s a quick summary to get you started on the path to renewal.

- Determine your license expiration date.

- Determine your continuing education requirements.

- Select and enroll in courses or webinars well in advance of your expiration date.

- Complete your courses – we submit your credits to the Department of Insurance the same day as you complete them.

- Renew your license. We’ll direct you through the entire process.

If you’re near your renewal date, there’s no time to be lost. Sign up now for the most trusted and convenient solution for keeping your California insurance license active with the new 2025 requirements.

We’re Here to Help you for California Insurance License

At BetterCE we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the insurance license renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to email as well as via our Contact Form. On our contact page, you can also sign up for convenient licensure renewal reminders.