Obtaining an Arizona insurance license is an important step for building a successful career as an insurance agent. To keep your license active and continue your practice without any interruptions, it’s crucial to follow the proper renewal procedures. By renewing your license on time and meeting the necessary requirements, you can avoid additional fees and ensure your business runs smoothly.

At BetterCE, we understand these challenges, especially regarding deadlines. Our online continuing education courses for insurance are designed to help you stay compliant. As an Arizona insurance continuing education provider, our primary goal is to ensure you enjoy a smooth, stress-free license renewal process.

This article provides the information you need about the late fees and penalties for missing Arizona insurance license renewal and the value of timely renewal.

What Happens When Your License Renewal Is Late?

All insurance agents must operate with a valid Arizona insurance license. However, if you do not renew your license on time, you must pay a penalty fee of $120 (in addition to the renewal fee of $100) before you can have your license reinstated. You have one calendar year from the expiration date of your license to complete the reinstatement process.

If you fail to renew your license within one year after its expiration date, you must file a new application for an insurance license. Filing for a new license can be tedious, and it comes with additional requirements, such as:

- Completing pre-licensing education

- Passing the qualifying exam

- Fingerprinting

- Paying initial licensing fees

- Gaining appointments

In Arizona, the Arizona Department of Insurance and Financial Institutions (DIFI) usually sends you a renewal notice via email 90 days before the license expires.

Avoid the Last-Minute Rush: Complete Your Insurance CE Requirements on Time

Arizona Insurance License Renewal Process

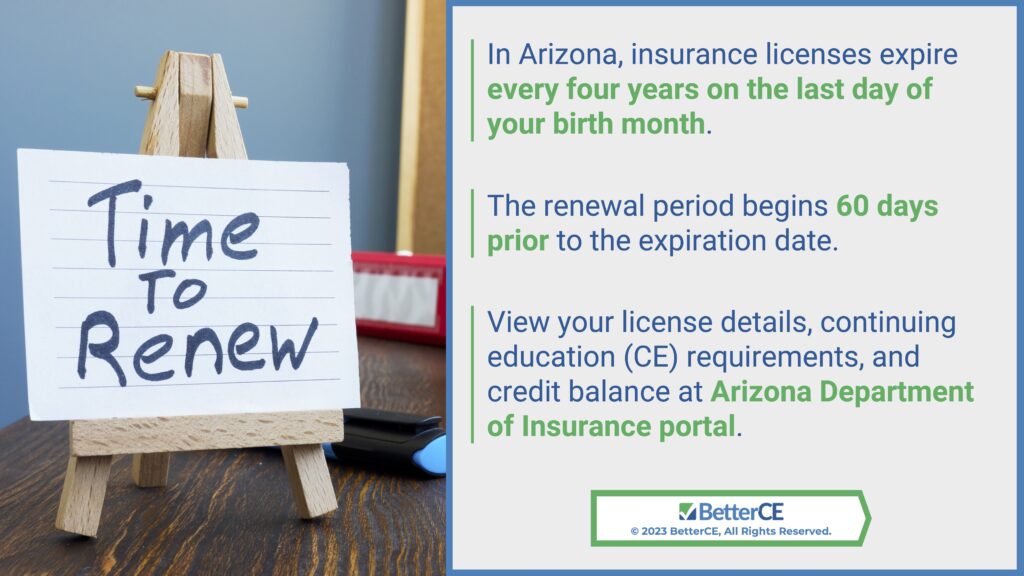

The process of renewing your insurance license in Arizona is quite straightforward, but it’s crucial to be aware of your license’s expiration date. An Arizona insurance license expires every four years, on the last day of your birth month. It is important to start the renewal process up to 60 days before this date.

If you are unsure about your license’s expiration date, you can log in to the Arizona Department of Insurance Portal to check it and find any other relevant information. If you delay the renewal until after your license expires, you will need to pay a late fee of $120, plus the $100 renewal fee.

Before you renew your Arizona insurance license, you must complete insurance continuing education. Follow the steps below to complete the Arizona insurance license requirements before the expiration date.

1. Complete Continuing Education

Before you can renew your Arizona insurance license, you should complete the required 48 hours of continuing education. At BetterCE, we make this process convenient and straightforward by offering a variety of Arizona continuing education courses, including webinars and online courses that you can complete at your own pace.

2. Application

Completing the renewal applications is the second step in renewing your Arizona insurance license. Visit the NIPR portal and enter your license information to locate your application, then complete the NAIC uniform application.

3. Pay the Renewal Fee

After completing the online application, pay the $120 renewal fee. If you miss the renewal deadline, you will have to pay $220 ($120 renewal fee + $100 late fee).

How to Maintain Your Arizona Insurance License and Avoid Fees and Penalties

You should do all you can to ensure that your Arizona insurance license is in good standing. That includes avoiding unnecessary fees and penalties, and here are a few tips on how to do that:

- Complete the 48 hours of your continuing education: Ensure that you complete the requirements for insurance continuing education in Arizona at least 5 days before your expiration date. Start at least 60 days before the expiry date to avoid last-minute stress.

- Make an early submission: Agents are eligible to renew their license after they have completed their CE Requirements and are within 90 days of their license expiration date. Avoid submitting your Arizona insurance license renewal at the last minute. Early submissions can prevent delays and costly penalties for lateness.

Take Charge of Your Arizona Insurance License Renewal

Take control of the Arizona insurance licensing renewal process to avoid late fees. Being proactive with your license renewal involves completing your continuing education on time and submitting your application well in advance.

You can also use BetterCE’s reminder services to ensure a smooth renewal process and avoid any business interruptions due to an expired license. Contact BetterCE today to get started with your Arizona continuing education.