One of the most common questions agents ask while completing insurance CE courses is: “Why does the final exam ask me to enter a Disinterested 3rd Party or Exam Monitor?” At BetterCE, we see this question most often from professionals taking self-study courses who are surprised by the extra step at the end. While states may use slightly different terminology, the purposes are the same: verifying that the person taking the exam is the licensed agent earning the credit and that they are not cheating on the final exam.

This article explores why final exam monitors exist, how different course delivery methods are regulated, and the practical options available to agents when a monitor feels hard to find.

Insurance CE Course Delivery Methods

1. Traditional Classroom Courses

Traditional classroom courses are delivered in person with a live instructor. Agents must be physically present for the full class time, and attendance is verified using sign-in sheets or roll calls. If a course offers 3 credits, the agent must attend the full 3 hours to earn those credits.

Attendance is the key compliance requirement in this format. Because the instructor and provider can verify presence in real time, there are typically no final exams and no monitors in the classroom model.

For many professionals, these CE classes for insurance feel straightforward because the “proof” is simply being there.

2. Online Delivery: Insurance CE Webinars

Insurance CE Webinars offer a similar experience to classroom courses but in an online, real-time format. Agents participate via computer or mobile device, and attendance is confirmed through online check-ins. As with classroom delivery, agents must remain present for the full duration to earn credit.

Since attendance is tracked during the session, no final exam or exam monitor is required. In other words, the compliance control is still “attendance,” just measured digitally.

For agents balancing a busy schedule, webinar-based CE classes for insurance can be a practical option for live instruction without travel.

3. Text-Based or Self-Study Courses

Self-study insurance continuing education courses present material in a text-based format (online or, rarely, in print). These courses are considered “assessment-based,” meaning agents must pass chapter quizzes and a final exam to earn CE credits for insurance.

Because there is no attendance verification, regulators require a method to confirm that the enrolled agent is the person taking the exam and to ensure that no one else helped or completed the exam on their behalf.

For this reason, many states mandate a Disinterested 3rd Party Exam Monitor for the final exam in self-study insurance CE courses.

Why States Require a Disinterested 3rd Party Monitor

Self-study courses allow agents to earn credits at their own pace, without attending a live class or webinar. That flexibility is useful, but it also removes the built-in safeguards that exist in attendance-based formats.

The Final Exam Monitor serves two core purposes:

- Identity verification: Confirming that the person taking the exam is the enrolled agent

- Academic integrity: Helping ensure the agent takes the exam without assistance

Instead of verifying physical attendance, regulators use this monitor requirement to support consistent standards across providers offering self-study insurance CE courses.

What Is a Disinterested 3rd Party?

Most states define a Disinterested 3rd Party as “an individual over age 18 who is not a family member, relative, or dependent; an employer or supervisor; an employee or subordinate; a business partner or joint-venture participant; or anyone who has a financial or personal interest in the agent’s exam outcome.” Some states allow coworkers, provided they are not under the agent’s supervision. This ensures the monitor has no incentive to misrepresent the exam results.

How the Monitor Requirement Works

When an agent gets to the final exam in a self-study course, the system first asks the exam monitor to enter their first and last name. After the monitor confirms that step, the agent can start the exam and earn credit by passing. In some states, such as Arkansas and Connecticut, a signed attestation is also required afterward.

These steps vary by jurisdiction, but the compliance goal remains the same: keep the exam tied to the correct licensee and maintain a fair process across insurance continuing education providers.

What If You Can’t Find a Disinterested 3rd Party?

Most agents use coworkers, neighbors, or friends who meet the criteria. For those working remotely or in isolated environments, one practical approach is to complete the coursework up to the final exam and then visit a local library, where staff can often serve as a Disinterested 3rd Party.

If finding a monitor is inconvenient, another option is to take Insurance CE Webinars instead. Webinars verify attendance during the session, so they do not require a final exam monitor. If an agent is unsure which format best fits their situation, BetterCE can help clarify the state rules and course options without overcomplicating the decision.

Key Takeaways About Final Exam Monitors

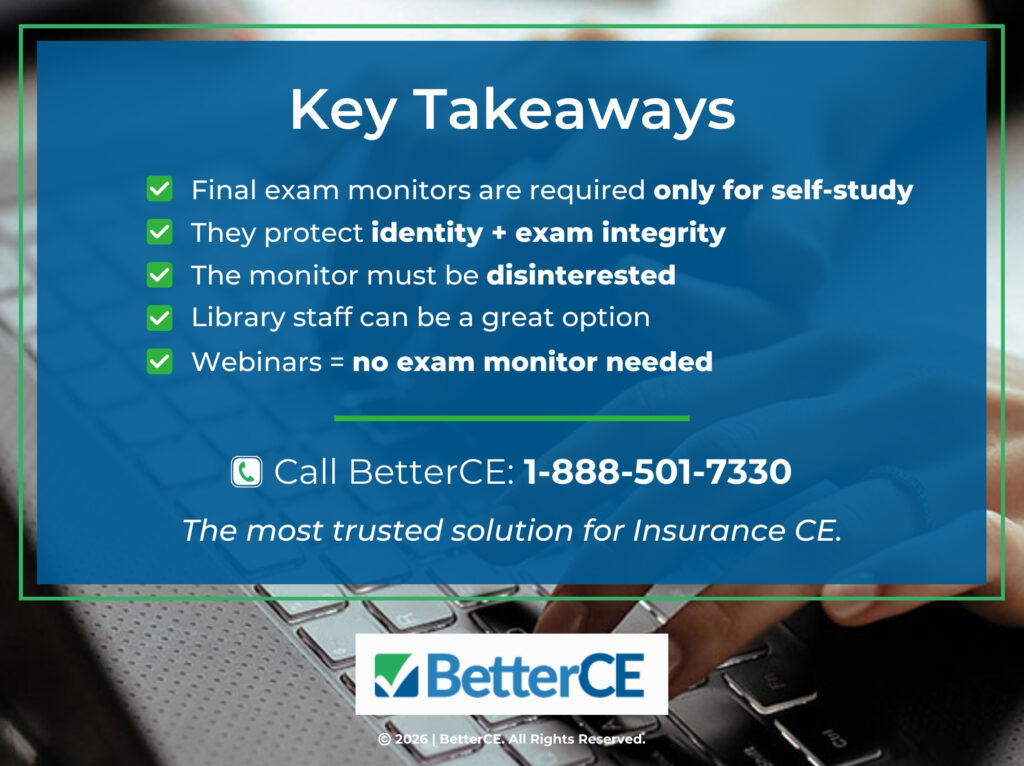

- Final Exam Monitors are required only for self-study insurance CE courses.

- The monitor verifies identity and exam integrity.

- A Disinterested 3rd Party must have no personal or financial stake in the agent’s exam outcome.

- Agents unable to find a monitor can complete their exam at a library or choose Insurance CE Webinars, which require no exam or monitor.

We hope this information is helpful to you. As always, call BetterCE, the most trusted solution for insurance CE, at 1-888-501-7330 if you have any questions or need assistance. Our compliance specialists are available to assist you.