Every insurance agent knows what it feels like to look at the calendar and realize their license renewal deadline is days away. The panic sets in. How will you complete your insurance education, pass the exams, and get your credits submitted in time?

At BetterCE, we have designed our platform to remove that stress. From immediate course access to twice-daily credit reporting, our system exists to help you meet your requirements, even when you are down to the wire.

This article outlines the tools and strategies BetterCE offers to help insurance professionals earn fast CE credits when time is short.

Why BetterCE Is Built for Urgent Deadlines

Some CE platforms feel generic. Ours is not. At BetterCE, we built every part of the experience around the reality that many insurance agents do not complete their CE requirements early.

Here is how we step in when others slow you down:

Super Easy Course Selection

Immediate Access to Courses

Once you check out, your courses are unlocked instantly. You can log in, open the material, and begin working immediately.

This is especially helpful when you need fast insurance CE credits on your own time. That can occur at any time, including late at night, early in the morning, or over the weekend.

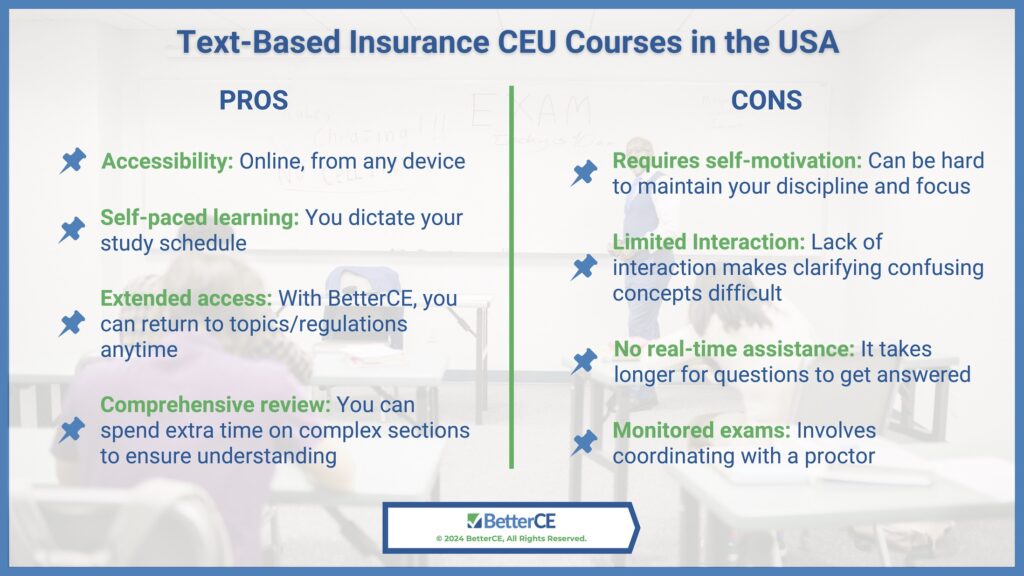

Self-Paced, Text-Based Format

Our most flexible courses are text-based and completely self-paced. You can move quickly through material you already know, pause when needed, and pick up where you left off on any device.

This format is ideal for insurance agents who have a solid understanding of the material and simply need to fulfill the requirement efficiently.

Same-Day Credit Reporting for Fast CE Credits

BetterCE submits course completions twice daily on weekdays: once in the morning and once in the evening. In the final days of the month, when CE volume spikes, we often report three times a day to ensure every CE credit for insurance agents is registered as quickly as possible.

Many competitors report once daily, or less, and some charge extra fees to rush your credit. We include it at no additional cost.

Make the Most of Our Flexible Online Format

We know that continuing education for professionals often happens during off-hours. BetterCE courses are entirely online, allowing you to complete them at your convenience, wherever and whenever you are ready.

You have access to two formats:

- Text-based self-study courses that let you move at your own pace

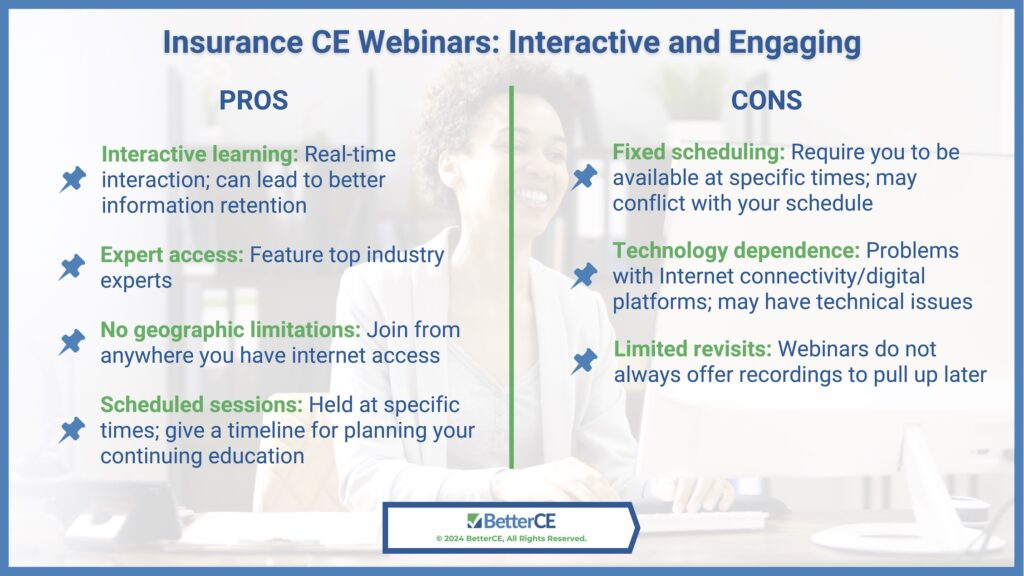

- Live webinars for agents who prefer instructor-led sessions

Even better, our courses include:

- Instant scoring for quizzes and final exams

- Unlimited retakes for most assessments

- Mobile-friendly design for use on your phone or tablet

Avoid Last-Minute Mistakes That Can Derail Your Renewal

When you are in a rush, it is easy to overlook details. Some agents forget how many CE credit units they need. Others complete courses that are not state-approved or omit required subjects, such as ethics or annuities.

To help prevent that, BetterCE includes:

- State-specific requirement pages that spell out exactly what you need

- Complete Compliance Packages that make course selection super easy.

- License renewal guidance to ensure you submit your application correctly

- Post-course email alerts that confirm when your credits are reported

- Customer support provided by compliance experts.

Use These Tips to Finish on Time Without Stress

Fast tools are only part of the solution. You still need a plan. Here is how to work smart when time is running out on your CE credit units:

- Finish at least 48 hours before your license expires. Even with fast CE credits for insurance agents, it helps to build in a buffer.

- Stick with text-based courses if your schedule is unpredictable. Webinars may not line up with your availability.

- Start with the required topics first (e.g., ethics, annuity suitability), so you do not miss them.

- Check your state’s requirements upfront to avoid wasting time on non-compliant content.

BetterCE’s platform makes all this easier. You get the structure, tools, and reminders to stay on track, even if you waited until the final week.

Choose a Platform That Actually Supports Fast CE Credits

Many providers offer online CE credits for insurance agents, but not all of them are designed for speed. BetterCE stands out because we provide:

- Immediate access to all courses

- Twice-daily credit reporting, even more at the end of the month

- Clear guidance on state rules, renewal steps, and next actions

- No extra fees for fast submission or processing

You should not have to pay more to have your credits submitted on time. And you should not have to worry that your CE provider is holding things up.

Our online, text-based courses and live webinars are available 24/7, with flexible formats and same-day reporting included.

Explore our course catalog now, pick your state, and see just how fast and easy CE can be. If you are running out of time, we are ready to help you finish on time.

Enroll now at BetterCE and let us take care of the rest.