Completing insurance license continuing education in the USA helps you maintain your certification, allowing you to focus on serving your customers effectively. Luckily, with the right knowledge and tools, you can streamline your learning to focus on keeping your credentials current. If you’re an insurance professional, understanding the process of obtaining and reporting CE credits is essential to your professional success. This article gives you the information you need to know how long it takes to report CE credits so you can manage your continuing education effectively and confidently.

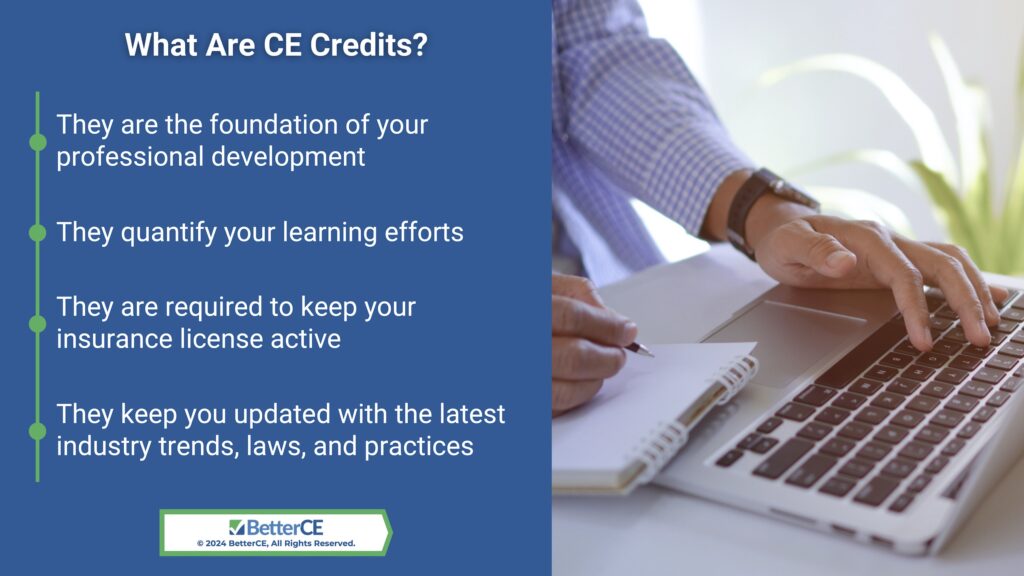

Understanding CE Credits for Insurance Agents

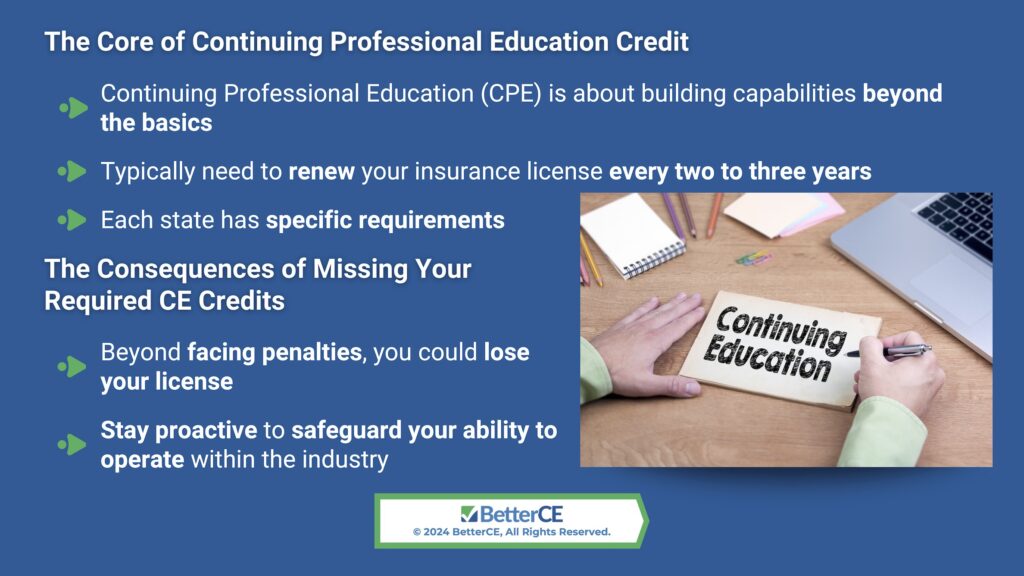

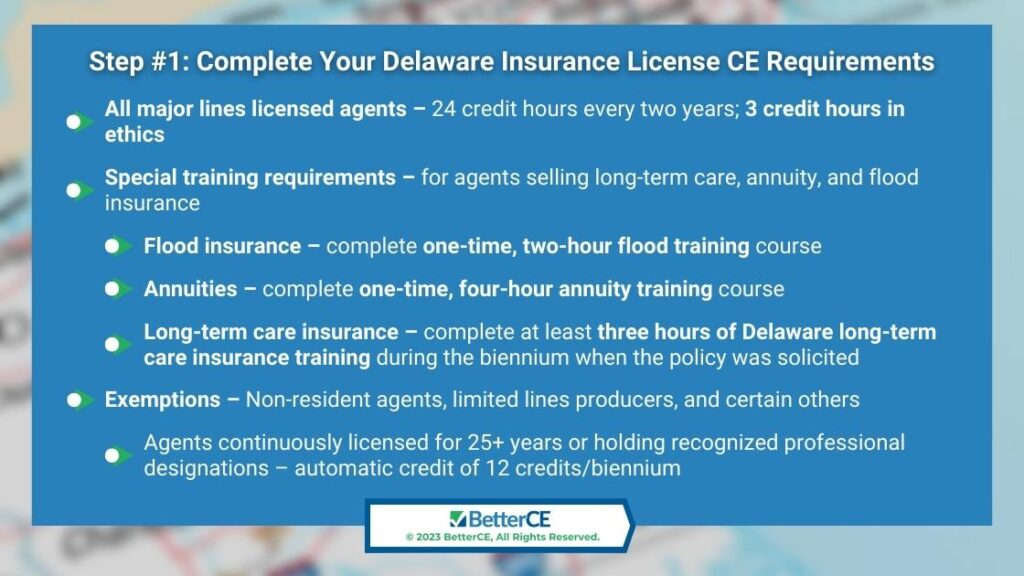

Insurance agents across the USA are required to earn continuing education credits to maintain their insurance licenses. States require them, so you stay informed and compliant with the latest industry standards and regulations. As an insurance professional, you must complete a certain number of hours of continuing education to renew your license periodically. This requirement varies by state but generally ranges from 12 to 24 hours every one to two years.

Some states also mandate specific courses, such as ethics. These CE credits play a significant role in your career development, enabling you to enhance your skills and deepen your knowledge. Of course, they also help you maintain your professional qualifications. At BetterCE, we provide a variety of online CE credits. These fit your busy schedule and meet state-specific requirements, empowering you to continue serving your clients effectively and ethically.

BetterCE Is Your Solution for Last-Minute CE

How and When Insurance CE Credits Are Reported

Completing your insurance license continuing education is just the first step in ensuring you stay up to date. How quickly your insurance CE credits get reported back to your state is just as important. At BetterCE, we are committed to efficiency by reporting your completion on the same day you finish your course. This swift reporting ensures that your credentials are always up to date, demonstrating your commitment to professional standards.

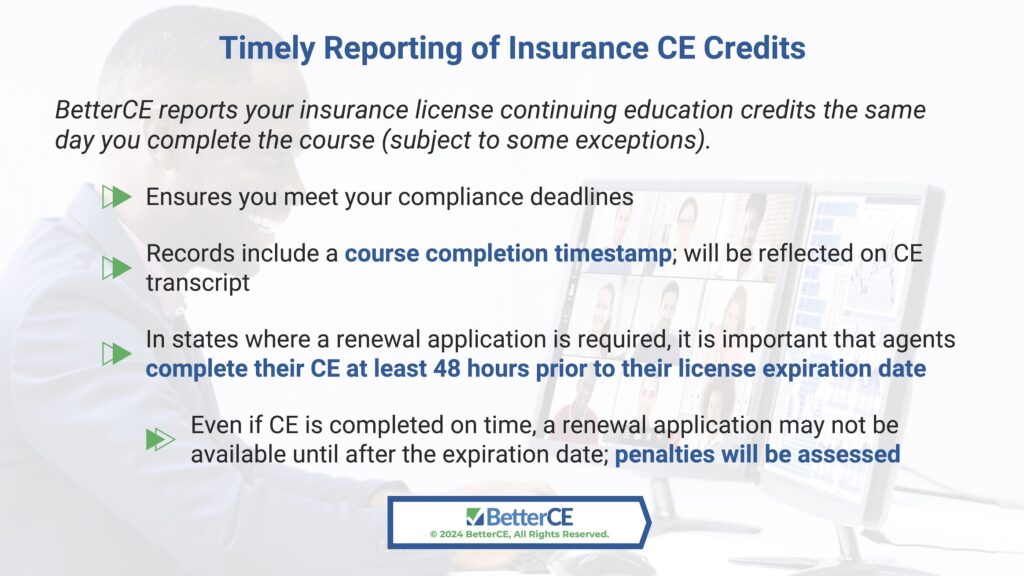

Timely Reporting of Insurance CE Credits

After you complete your CE classes for insurance, the reporting process to your relevant state authority usually happens very quickly. For instance, BetterCE reports your insurance license continuing education credits the same day you complete the course (subject to some exceptions). This quick turnaround is extremely important during your renewal periods, as it ensures that you meet your compliance deadlines before any penalties are applied.

Quick reporting helps safeguard against these risks, enabling you to maintain a good standing without any stressful interruptions to your practice. Remember, your records note the timestamp of your course completion. Even if it takes until the next day to file your credits, the date of completion is reflected on your CE transcript.

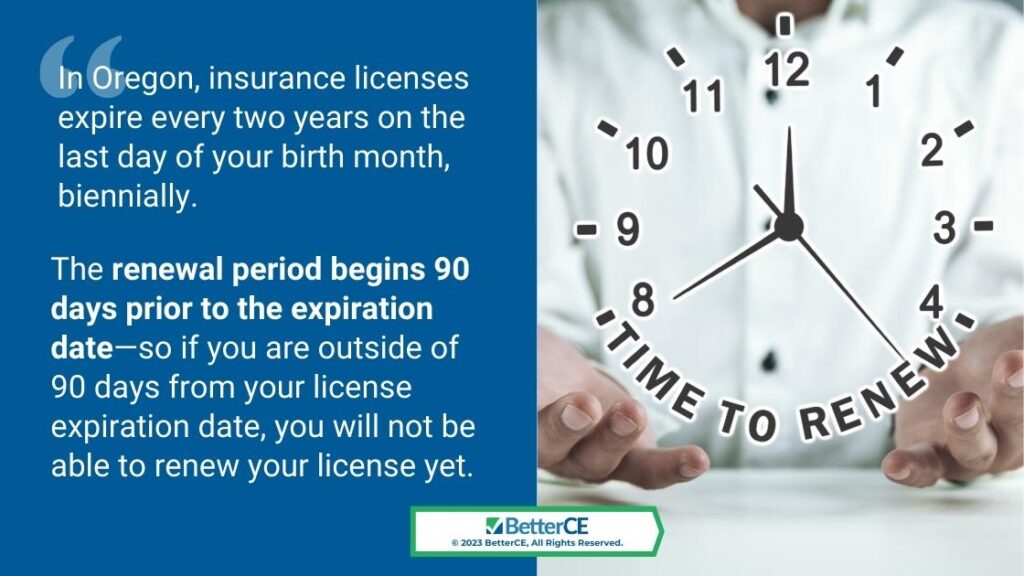

It is especially important to note that many state departments of insurance require all CE credits to be completed before your renewal application is made available. For this to occur, their systems require 12-24 hours to update your records and make your renewal application available. So, even if you do complete your CE prior to your license expiration date, your renewal application may not be made available until after your expiration date has passed.

In those cases, the agents may be assessed penalties for late renewals, even though their CE was completed and reported on time. Although we offer the fastest credit reporting among CE providers, we always recommend that agents complete their CE at least 48 hours in advance of their license expiration date. This is especially true for agents who are licensed in the vast majority of states that require agents to complete a renewal application.

Pros and Cons of Text-Based Insurance Education vs. Insurance CE Webinars

Check Your Insurance License Continuing Education Credits

Ensuring that your CE credits are reported correctly and that your report is up-to-date is the responsibility of every insurance agent. You can take several straightforward steps to verify your CE status:

- Use Our “Next-Step Reminders”. Every time we report your credits, we send you our “Next-Step- Reminder” email, which notifies you that your credits have been submitted, reminds you of any renewal requirements, and contains links for you to access and view your CE Transcript.

- Use the Resources Available on Our State Catalog Pages. On each catalog page, we offer the most important resources agents need to manage their licenses. Agents can view their CE Transcript, access their renewal application, visit their state department of insurance website, and view their state-specific licensing and renewal requirements.

- Use the Resources Available on Our State Requirements Pages. On these pages, we provide agents with all the necessary information and resources to maintain an active license. Agents can review their state-specific CE Requirements, access their license information and status, view their CE transcript, view licensing deadlines, renewal fees, and late penalties, and access contact information for their state department of insurance.

- Sign up for Our “Compliance Reminders”. Every month, we keep thousands of insurance agents updated on their renewal requirements and deadlines. Simply enter your information, and we’ll send you reminders as your expiration date nears. It’s FREE, we never share your email address with anyone, and you can unsubscribe or opt out at any time.

- Contact Our Office. Our call support team is comprised of compliance specialists. They can help you navigate any licensing or compliance questions you have or point you in the right direction in the rare case they are unable to resolve your particular situation.

Take Charge of Your Professional Growth: Act Now on Your Insurance CE Credits

Your role as an insurance agent requires a commitment to continuous improvement and adherence to industry standards through insurance license continuing education. BetterCE is here to help you meet your continuing education needs on time and to standard. Explore our full catalog of courses tailored to fit the dynamic needs of insurance professionals across the USA.

If you have any questions or need guidance on the reporting process for your CE credits, please don’t hesitate to contact us or visit our website. Stay proactive about your professional learning journey and make sure your insurance knowledge remains current in an ever-evolving industry.