A few key statistics on eLearning demonstrate the power of webinars and online self-paced continuing education:

- Learning retention rates are 25-60% versus 8-10% for face-to-face training.

- Participants learn nearly five times more material without increasing the time spent in training.

- Time savings are 40-60% over traditional classroom training.

This article provides further insight into the incredible power of insurance CE webinars for continuing education.

What Is a Webinar?

A webinar is an online instructor-led presentation using video conferencing. Instructors share their screens, files, and knowledge via audio and video. It is conducted in real-time, which allows students to interact by asking questions and receiving answers, helping them and their fellow students better understand the content.

What Are the Powers of Insurance Webinars for Continuing Education?

We’ve highlighted the significant powers of insurance CE webinars in this list.

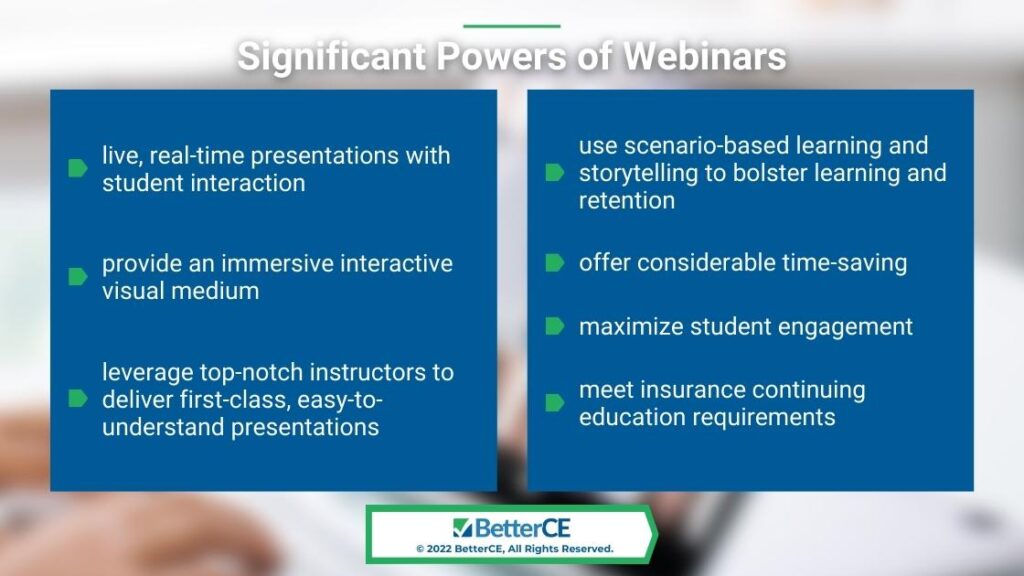

- Webinars are Live, Real-Time Presentations with Student Interaction. Live presentations often capture the audience’s attention, and student interaction keeps the audience engaged and learning throughout the presentation.

- Webinars Provide an Immersive, Interactive Visual Medium. Classroom presentations used to involve “chalk and talk” with an instructor using a marker and whiteboard, if not the actual chalk and blackboard. No longer, webinars allow the full use of video, animation, and well-developed slide decks.

- Webinars Leverage Top-Notch Instructors to Deliver First-Class Easy-to-Understand Presentations. It used to be that presentations across several states required quite a few instructors to keep up with the demand at a distance. Not so with webinars. Now the best instructors can deliver their best to everyone with Internet access.

- Webinars Use Scenario-Based Learning and Storytelling to Bolster Learning and Retention. Those top-notch instructors bring great stories that help capture critical concepts. Those stories and scenarios help students better understand the content, retain that learning, and put the principles to use in their work.

- Webinars Maximize Student Engagement. Add it all up, from student interaction to immersive visual presentations to top-notch instructors and storytelling, and you’ve achieved an incredible degree of student engagement. This is a considerable power of webinars for continuing education.

- Webinars Offer Considerable Time-Saving. As noted in the study quoted above, time-saving is a crucial benefit. Since webinars are delivered to you via any computer, smartphone, or tablet with an Internet connection, there is no travel time, hassle, or cost involved.

- Webinars Meet Insurance Continuing Education Requirements. Many states mandate classroom or classroom-equivalent attendance for students to receive insurance continuing education credits. Fortunately, almost every state insurance regulator now approves live insurance CE webinars as if they were traditional classroom courses. States also require verified attendance. Here at BetterCE, attendance is confirmed by requiring students to check in randomly throughout the webinar. And students are not seen on screen, so you can even wear those fuzzy bunny slippers you love!

The State of Continuing Education 2022 reports that 56% of higher education professionals find that the role of continuing education has dramatically expanded through the pandemic. At the same time, they are also responding to the rapidly declining population of traditional college students, with a loss of over one million students between fall 2019 and fall 2021. All this adds up to a growing realization that colleges and universities need to reach adult learners with training focused on non-degree certificates and industry credentials.

BetterCE is already there, serving insurance agents and state departments of insurance by providing the best online and webinar continuing education in the business. We’ve been providing continuing education for years, backed up by our extensive experience in the insurance industry, including licensing compliance.

Now is the Time to Start Your Insurance Continuing Education

You can find the continuing education webinars available in our course catalog. Select your state to view the continuing education requirements, online courses, and webinars. You’ll also find complete course packages and easy registration.

Certificates of course completion are generated shortly after course completion. We report your continuing education course credits to the state insurance department the same day you complete the training.

We also offer online, text-based self-paced training. See our blog article Differences Between Webinar Courses and Traditional Online Text-Based Courses for further information on finding just the right balance of coursework for your continuing education.

To make course selection super-easy for students, we offer our “complete compliance packages”. Each package is made up of our most popular courses, and is designed specifically to meet the compliance requirements for every type of agent – all you need to know is the license type you hold. Of course, we also offer individual courses so that you can pick and choose the type of training that best meets your learning needs.

Start today with Better CE. On our Course Catalog Page, you can select all the courses you need with one click!

At BetterCE, we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the renewal process.

Have a question or need assistance? Call 1-888-501-7330 for our customer care team. We also respond to emails via our Contact Form. On our contact page, you can sign up for convenient license renewal reminders.