This article covers all the steps you’ll need to follow to keep your insurance license active in Missouri. We’re confident that the BetterCE straightforward two-step process can help you renew your license quickly and without fuss.

Every two years, you need to renew your insurance license. This must be done within 90 days prior to the license expiration date, which is on the last day of your birth month.

There are only two steps required to keep your license active:

- Complete the required continuing education.

- Submit your renewal application prior to expiration.

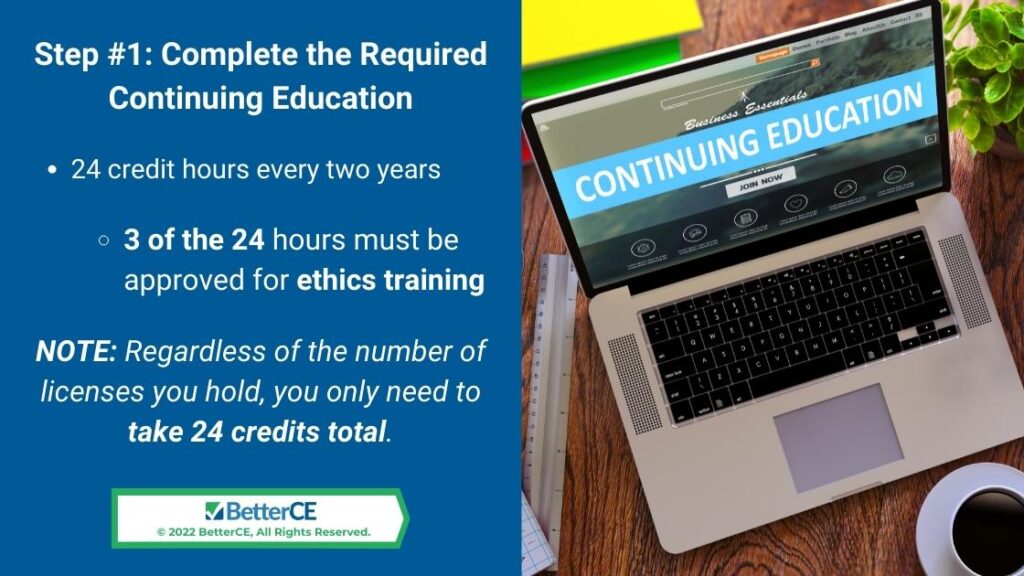

Step #1: Complete the Required Continuing Education

The Missouri Department of Insurance requires that all major lines licensed agents complete 16 credit hours of state-approved continuing education every two years. Major lines are those agents who are licensed to sell: Life, Accident and Health, Property, Casualty, and Personal Lines. Of the 16 credits required, at least 3 credits must be approved for ethics.

Missouri course requirements are “license type-specific.” This means agents must take courses specifically approved for their license type. As one example, agents who hold a life insurance license only must take courses approved for life insurance agents. Agents who hold more than one type of license (Life and Property, for example) can take courses approved for at least one of the license types held, or a combination of courses approved for both of the license types held.

Special training requirements exist for agents selling long-term care or flood insurance.

- Agents who sell long-term care policies must complete an initial 8-hour long-term care course prior to selling and then a 4-hour long-term care training every renewal period following.

- Property and Casualty Agents who sell flood insurance must complete a one-time 3-hour continuing education course related to the National Flood Insurance Program (NFIP) prior to selling.

Other than the ethics course and any special training requirements, you can take courses in any subject matter as long as they are approved by the insurance department.

Step #2: Submit Your Renewal Application Prior to Expiration

After completing your CE requirements, the last step you need to take is to renew your Missouri insurance license. This must be done on or prior to your license expiration date but not more than 90 days in advance of your expiration date.

You can access your renewal application and file it online at NIPR Missouri License Renewal or Sircon License Renewal.

Now Is the Time to Start Your Continuing Education

Even with a full two years to accumulate your 16 hours of continuing education, there’s no reason to wait to get started. BetterCE has you covered with all the courses you need. You can find the complete listing in our Missouri Insurance Continuing Education Course Catalog.

The online training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off.

Our webinar courses are instructor-led and delivered live using video conferencing. You’re required to be in attendance for the entire class time, with check-ins at random times throughout the webinar to confirm your attendance. Students can interact and ask questions. The advantages of webinars include no required reading and no quizzes or final exams. You can view a listing of our webinars here: Missouri Webinar Catalog.

Completions Reported the Same Day

Note that our office will report your continuing education course credits to the Missouri Department of Insurance the same day you complete the training. So, if you’re in a rush to complete your continuing education, we’ve got you covered.

Summary of Steps to Keep Your Insurance License Active in Missouri

Even though we’ve mapped it out above, it’s still a great deal to digest. Here’s a quick summary to get you started on the path to renewal.

- Determine your license expiration date.

- Determine your continuing education requirements.

- Enroll in courses well in advance of your expiration date.

- Complete your courses – we submit your credits the same day you complete them.

- Renew your license.

We’re confident that everything you need to keep your license active is easily accessible through our website. If not, simply call our office, and we’ll happily assist you.

There’s no time to be lost if you’re near your renewal date. Sign up now for the most trusted and convenient solution for keeping your license active.

We’re Here to Help

At BetterCE, we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents navigate the renewal process easily.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to email as well as via our Contact Form. You can also sign up for convenient license renewal reminders on our contact page.