Unfortunately, the answer is…it depends. In most cases, you can, but it depends on what state you’re licensed in and, in almost all cases, you’ll have fines to pay. Not only that but you can’t work as an insurance agent with an expired license.

It’s best to complete the required continuing education and renew your license well before it expires. In this article, we touch on a few specific state examples. We then point you in the right direction for your state’s renewal process.

Renewal Regulations — Every State Has Their Own

Every state has its own insurance regulations including what’s required for renewal as well as what happens when your license is allowed to expire. We’ve dug a bit deeper into a few select states to give you an idea of what’s involved. If you live in a different state, you’ll need to check that state’s regulations. More on that next.

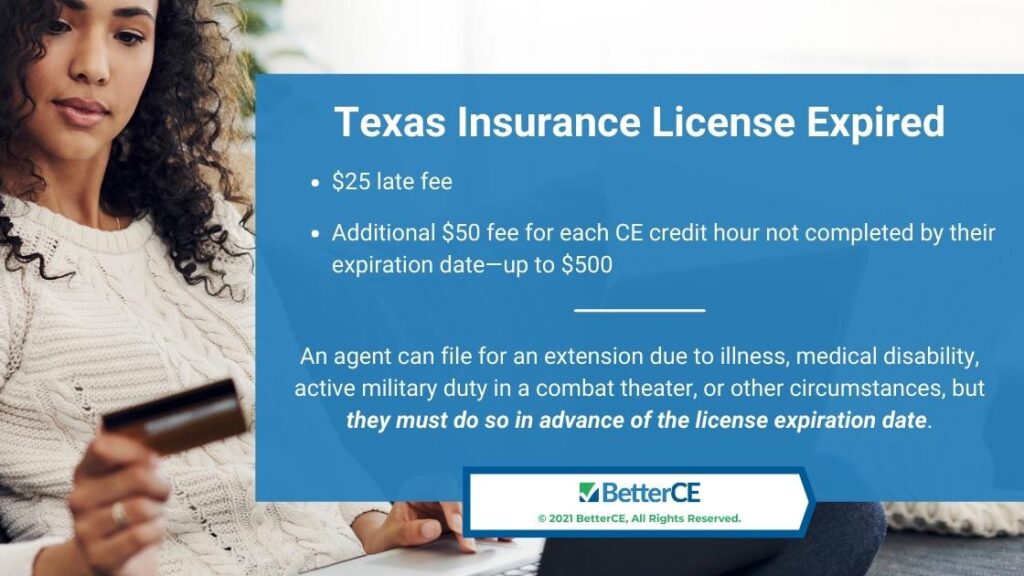

Texas Insurance License Expired

In Texas, if an agent doesn’t renew their license in time, there is a $25 late fee. In addition to this, agents must pay an additional fee of $50 for each credit hour of continuing education that has not been completed by their expiration date, up to a maximum of $500.

An agent can also file for an extension of time to complete continuing education due to illness, medical disability, active military duty in a combat theater, or other circumstances, but they must do so in advance of the license expiration date. For more information on renewing an insurance license in Texas, see our article How Do I Renew My Insurance License in Texas.

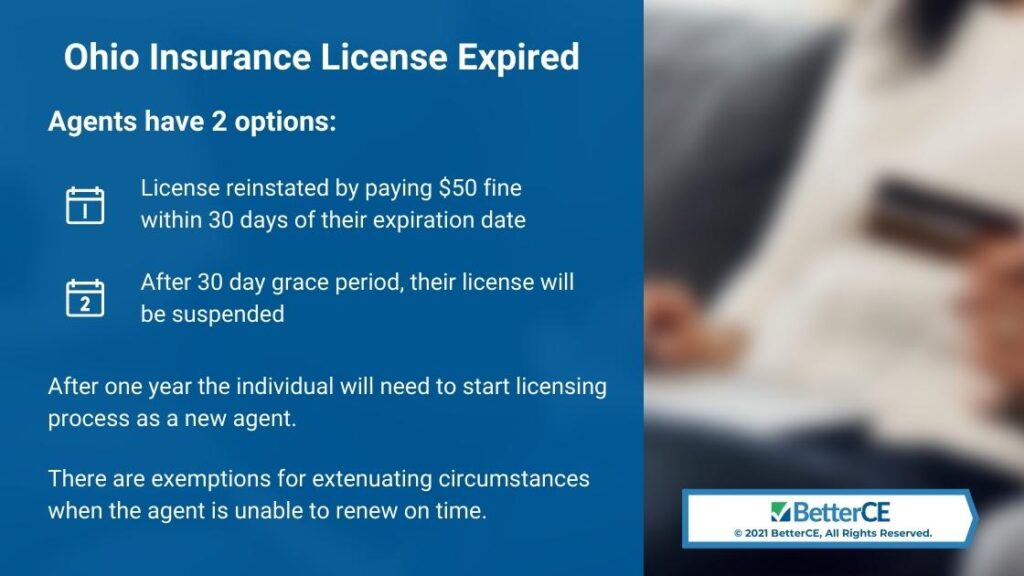

Ohio Insurance License Expired

Ohio insurance agents who do not renew their license by their expiration date have 2 options: 1) they can have their license reinstated within 30 days of their expiration date by paying a fine of $50; or 2) if they do not renew within the 30 day grace period, their license will be suspended and they have up to 1 year to pay a fine of $100 to have their license reinstated. In all cases, agents must fulfill their CE requirements prior to submitting the renewal/reinstatement application. After one year the individual will need to start the licensing process as a new agent.

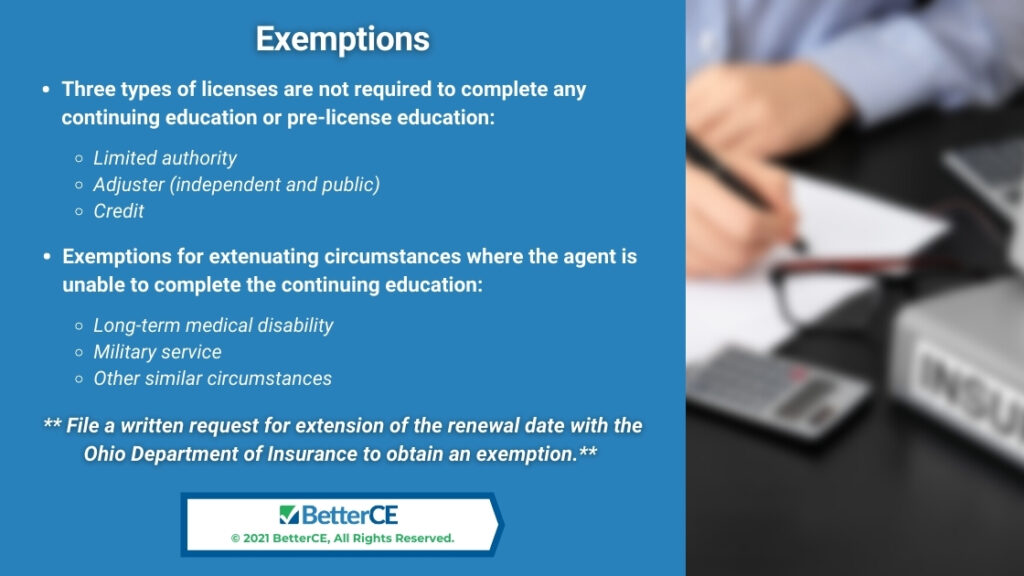

There are exemptions for extenuating circumstances when the agent is unable to renew their license in time. These include long-term medical disability, military service, and other similar circumstances. To obtain the exemption, you must file a written request for an extension of the renewal date with the Ohio Department of Insurance. In almost all cases, agents who are granted an extension will still have to complete their CE requirements prior to having their license reinstated.

For more information on license renewal see our article How to Keep Your Insurance License Active in Ohio.

California Insurance License Expired

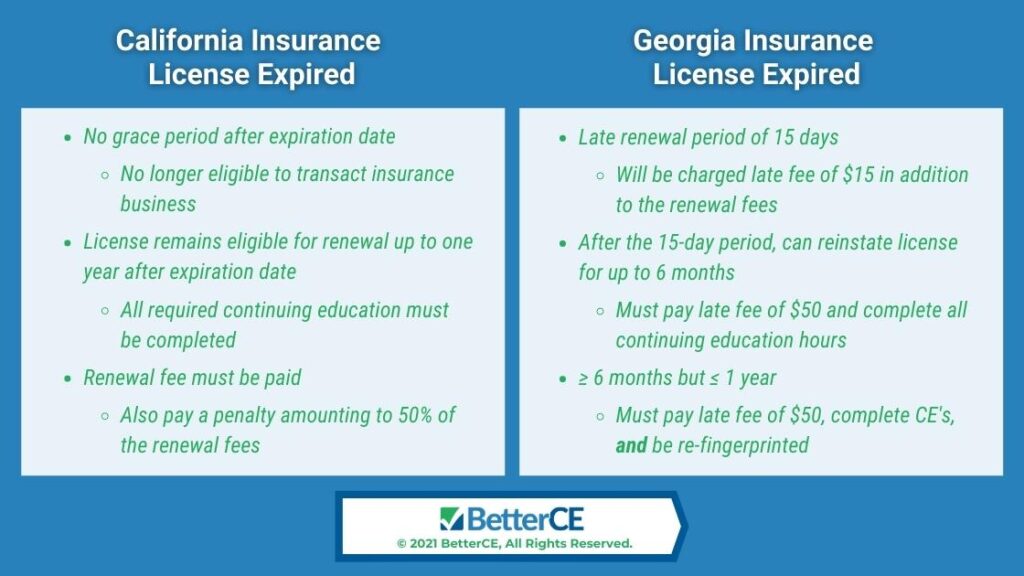

Insurance agents with California licenses have no grace period after the expiration date. Once the license expires, they are no longer eligible to transact insurance business. The license does remain eligible for renewal up to one year after the expiration date. During that time all required continuing education will need to be completed, and the renewal fee must be paid in addition to a penalty amounting to 50% of the renewal fees. You can find the full listing of fees at State of California Producer Licensing Fees.

You can find out more about renewing at How to Keep Your Insurance License Active in California.

Georgia Insurance License Expired

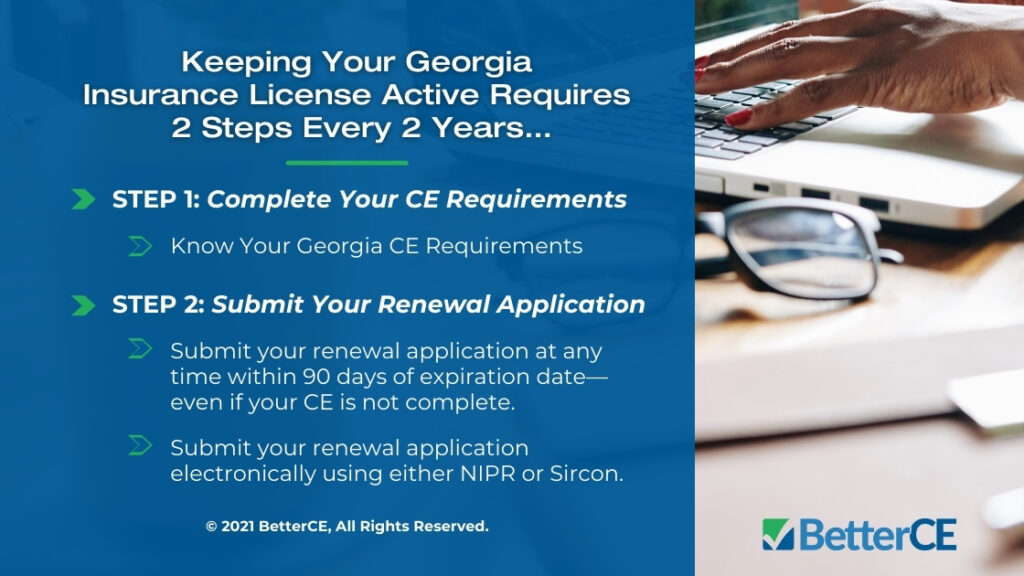

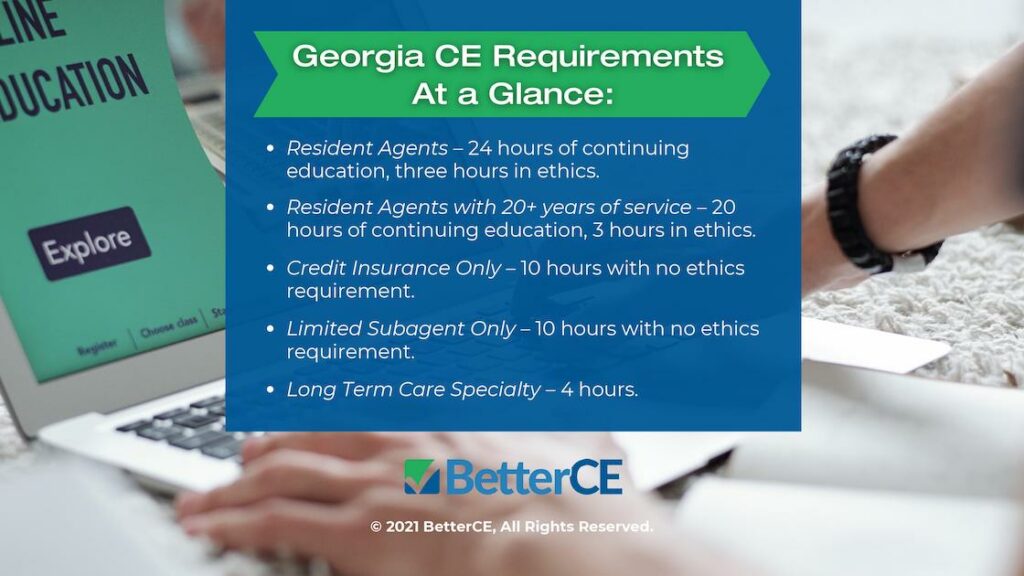

Producers in Georgia have a late renewal period of 15 days, during which time they are charged a late fee of $15 in addition to the renewal fees. After the 15-day period, agents can reinstate their license for up to 6 months for a late fee of $50. After 6 months and up to 1 year, agents must pay the late fee of $50 and be re-fingerprinted. If the agent waits beyond 1 year from their expiration date, their licenses are canceled and they must relicense. Of course, all CE requirements must be completed prior to reinstating. You can find out more about renewing your license at How to Keep Your Insurance License Active in Georgia.

Don’t Let This Happen to You

As you can see from the examples above, the renewal procedures for expired insurance licenses vary quite a bit across just those four states. If we haven’t covered your state, use our Course Catalog to get started determining the continuing education requirements, and follow the links to the state department of insurance to learn more about reactivating an expired license.

Sign Up for Continuing Education Now

Whatever the outcome of your review of renewal or reinstatement requirements, it’s likely that you’ll need to complete at least some if not all of your state’s continuing education requirements. We’ve got you covered with both online training and insurance CE webinars.

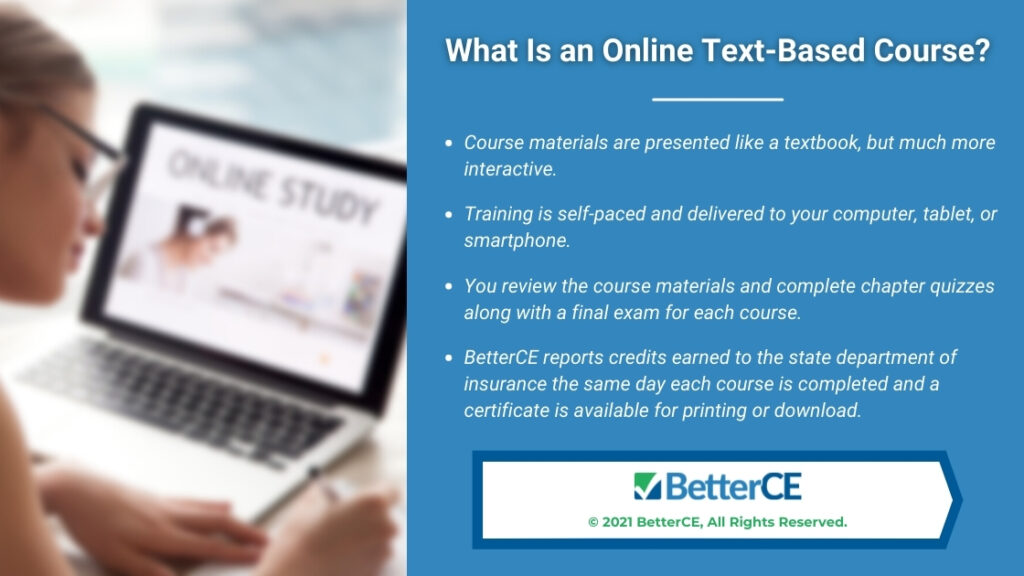

The online training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off. This is a relatively quick way to accomplish your CE requirements.

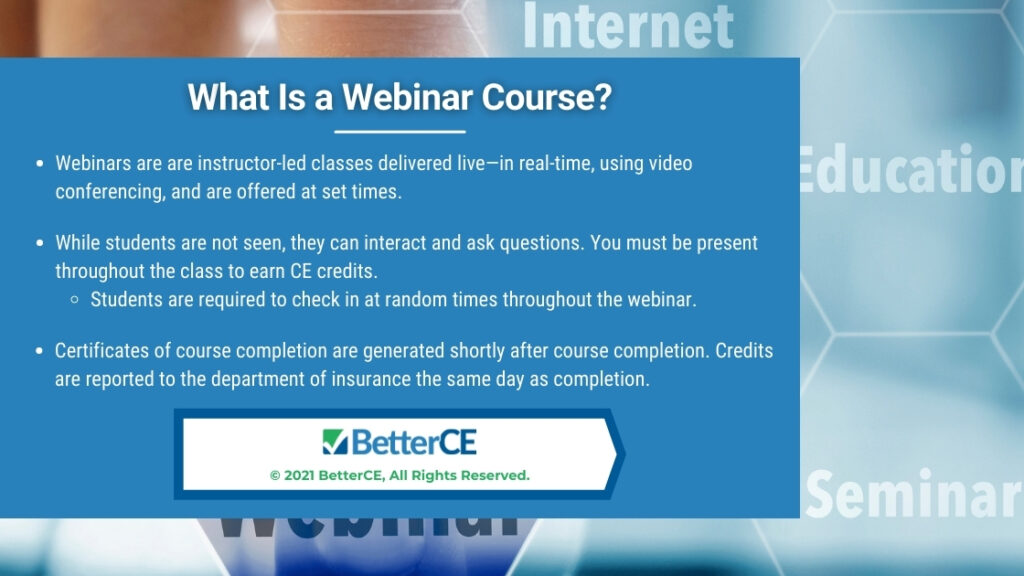

Our webinar courses are instructor-led and delivered live using video conferencing. You’re required to be in attendance for the full class time, with check-ins at random times through the webinar to confirm your attendance. Students can interact and ask questions. The advantages of webinars include no required reading and no quizzes or final exams.

Completion Reported the Same Day

Note that your continuing education course credits will be reported directly to the state’s department of insurance on the same day you complete the training. So, if you’re in a rush to complete your continuing education, we’ve got you covered.

We’re Here to Help

At BetterCE we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the insurance license renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to email as well as via our Contact Form. On our contact page, you can also sign up for convenient license renewal reminders so that you never have to deal with an expired license.